It’s a difficult issue to grasp – some company founders and owners actually want their share prices to decline! Why? So that they can take the company private at a cheap valuation. I don’t think that the stock market really has understood this with respect to Swatch.

The successful watch companies now are largely in private hands, with the exception being the Richemont company. Breitling is private but coming to the market soon, under the ownership of Partners Group.

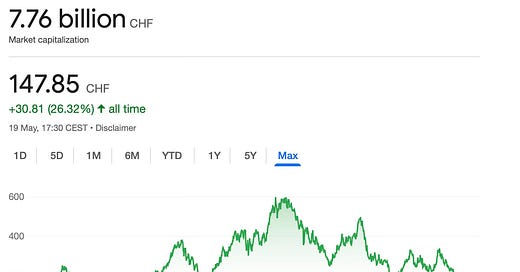

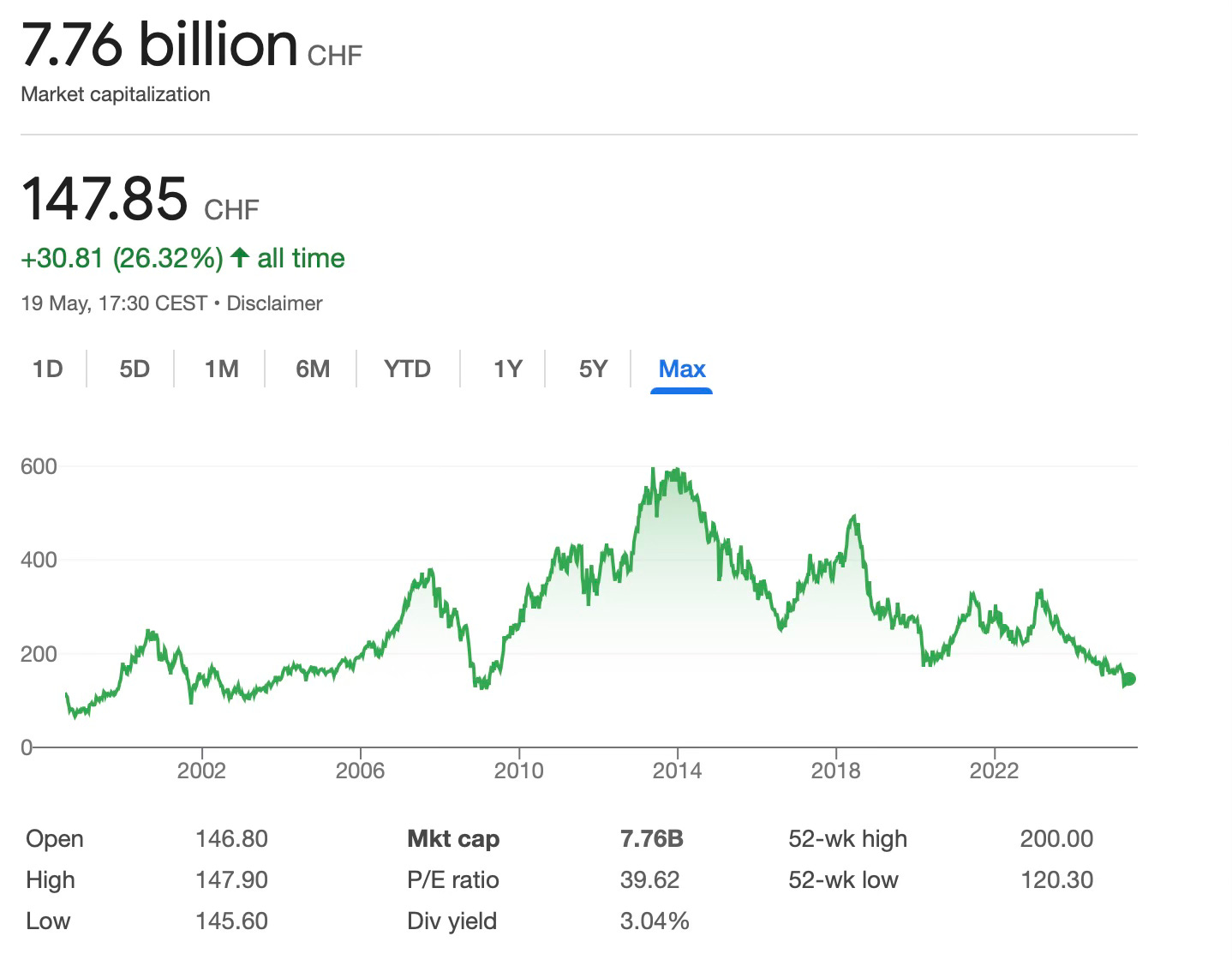

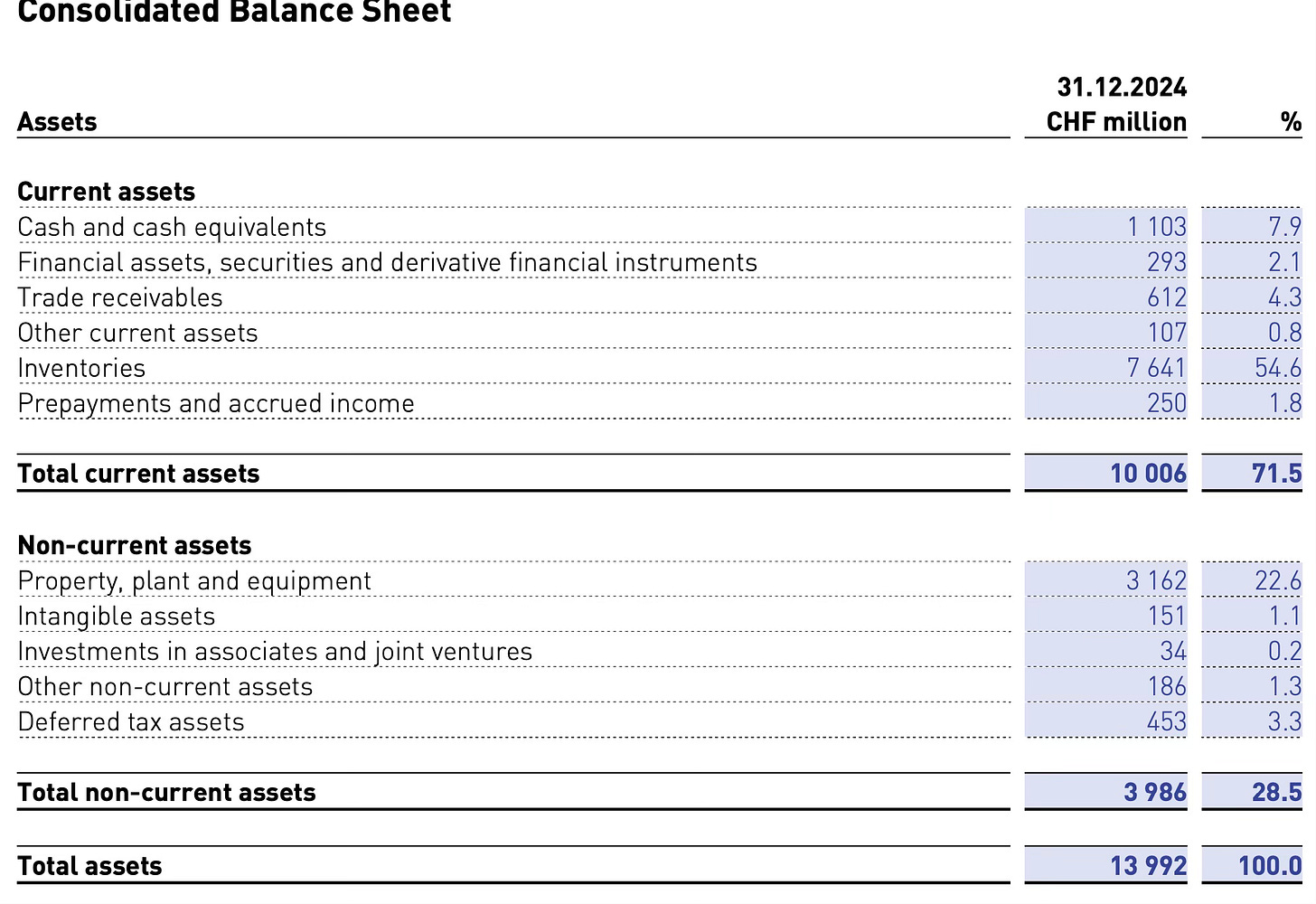

Swatch has been a classic “value trap” for many years, but there comes a moment when “you can’t fall off the floor”. Look at the market value of the company of ca. CHF 7 billion versus the assets on the balance: the inventories are worth the same. Trading at 0.5x book value, I think there is significant upside from here.

The company has long been irritated by having to interact with investors and analyst and now it has a small activist asking for a board seat. I think the family will soon say: “Enough Already!

”